FAQs

Product

The BigPay Lifestyle Insurance is offered by BigPay Malaysia Sdn Bhd for purchase by BigPay users only. The product is offered by BigPay in conjunction with BigPay’s affiliate partnership with Allianz General Insurance Company (Malaysia) Berhad (“Allianz”) and SenangNVS Sdn Bhd (“Senang”). This Personal Accident (PA) policy provides compensation in the event of death, injuries, disability or losses caused solely by accident. It also provides protection for life's daily risks protecting your online purchases, loss of smart device & sports equipment

The underwriter is Allianz General Insurance Company Berhad.

SenangNVS Sdn Bhd (“Senang”) is a PIAM registered agent (Agent Registration no: 185963-00) of Allianz and is the servicing agency appointed by Allianz to manage and administer the BigPay Lifestyle Insurance product

Insured Person must be between the age of eighteen (18) years old and the age of seventy (70) years old. This policy can be purchased by Malaysians and non-Malaysians. For non-Malaysians, you must be a Malaysian permanent resident, work permit holder, pass holder or otherwise legally employed or legally residing in Malaysia.You must have valid documents to make a claim.

This policy is only available for registered users of the BigPay mobile application. Ages referred to in this Policy shall be in reference to the age as at the last birthday.

For product enquiry, claim matters or complaint, please contact us via any of the following channels:

Call us at 1300-13-3388

Email us at support.my@bigpayme.com

Coverage

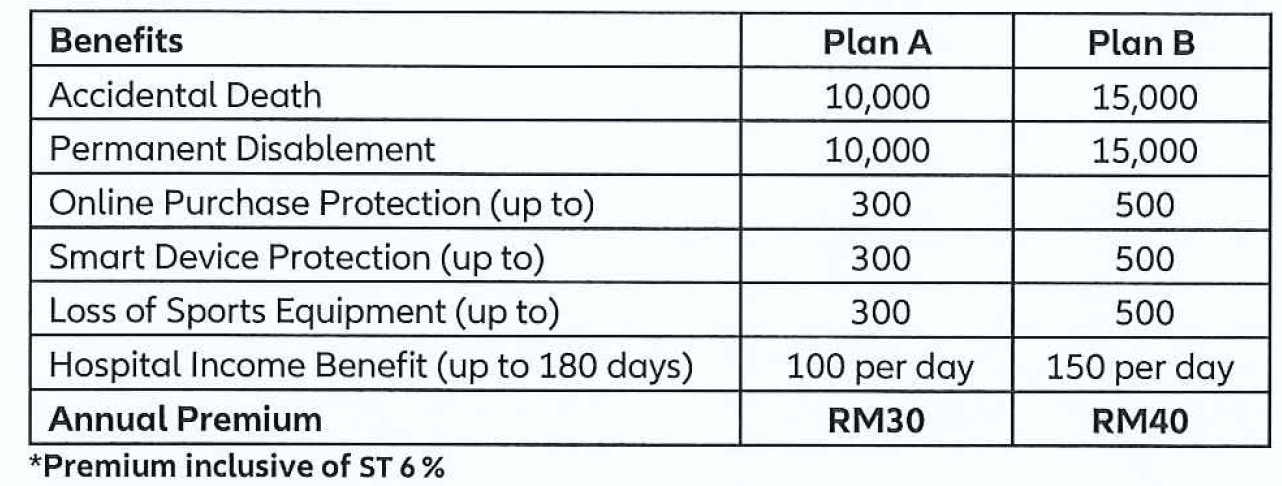

The following benefits are payable up to the Sum Insured as stated in the Schedule according to the plan selected by the Insured Person and subject to the terms and conditions of this Policy.

The Company will compensate the purchase price incurred by the Insured Person up to the amount specified in the Schedule for the loss of goods purchased:

- from a Fake Website/Application provided that the loss is reported to the police upon the discovery that the website/application is a Fake Website/Application; OR

- in the event the Purchased Goods were not delivered to, lost or not received by the

Insured Person provided that:

- payment for the Purchased Goods were made through a valid web site/application;

- the Purchased Goods were not delivered for more than fourteen (14) days from the date of the scheduled delivery;

- the delivery company has confirmed that the Purchased Goods were lost or cou ld not be found and will not make any compensation to the Insured Person; and

- the seller of the Purchased Goods refuses to refund, replace or compensate the Insured Person.

This benefit is payable for either Benefit D (Online Purchase Protection) (a) or (b) and shall not exceed the amount specified in the Schedule. This benefit is limited to two (2) claims during the Period of Insurance. The Company will not pay for:

- ( any financial loss incurred by the Insured Person which can be recovered or compensated by a licensed financial institution or other sources as determined by the Company in its absolute discretion;

- the loss of Purchased Goods if the Insured Person fails to provide proof of the nondelivery of Purchased Goods;

- non-delivery of Purchased Goods due to incorrect address provided by the Insured Person;

- any tax, insurance cost and surcharge in relation to the delivery;

- the loss of Purchased Goods resulting from any illegal or unlawful act by the Insured Person or confiscation, detention, destruction of the Purchased Goods by customs or other authorities;

- any consequential loss not specified in the Policy; and

- any purchase of goods made through any social media platform.

In the event of loss or damage to the Insured Person’s Smart Device as a consequence of:

- forcible and violent breaking-in or out of a premises; or

- Snatch Theft or Attempted Snatch Theft; or

- forcible and violent break-in into a vehicle, subject to the vehicle being secured/locked; the Company will compensate the Insured Person less a deduction for any wear, tear or depreciation, up to the amount specified in the Schedule provided always a police report is lodged within twenty four (24) hours of occurrence of the incident. This benefit is limited to two (2) claims during the Period of Insurance.

In the event of loss of the Insured Person’s Sports Equipment as a consequence of:

- forcible and violent breaking-in or out of a premises; or

- Snatch Theft or Attempted Snatch Theft; or

- forcible and violent break-in into a vehicle, subject to the vehicle being secured/locked; the Company will compensate the Insured Person less a deduction for any wear, tear or depreciation, up to the amount specified in the Schedule provided always a police report is being lodged within twenty-four (24) hours of occurrence of the incident. The Company will not pay for:

- loss of hired or leased equipment; and

- sports attire and shoes. This benefit is limited to two (2) claims during the Period of Insurance.

In the event of loss of the Insured Person’s Sports Equipment as a consequence of:

In the event of loss or damage to the Insured Person’s Smart Device as a consequence of:

- forcible and violent breaking-in or out of a premises; or

- Snatch Theft or Attempted Snatch Theft; or

- forcible and violent break-in into a vehicle, subject to the vehicle being secured/locked; the Company will compensate the Insured Person less a deduction for any wear, tear or depreciation, up to the amount specified in the Schedule provided always a police report is being lodged within twenty-four (24) hours of occurrence of the incident. The Company will not pay for:

- loss of hired or leased equipment; and

- sports attire and shoes. This benefit is limited to two (2) claims during the Period of Insurance.

This Policy does not cover death or any Injury or Permanent Disablement directly or indirectly caused by or in connection with any of the following:

- War, invasion, act of foreign enemy, hostilities (whether war be declared or not), civil war, rebellion, revolution, insurrection, military or usurped power;

- Insanity, suicide (whether sane or insane), intentional self-inflicted injuries or any attempt thereat;

- Intoxication beyond the legal limit related to the driving offence and/or under the influence of illegal drugs;

- Any form of disease, infection or parasites and Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC) or Human Immunodeficiency Virus Infection (HIV).

- Childbirth, miscarriage, pregnancy or any complications thereof, unless solely caused by an Accident;

- Provoked murder or assault;

- While travelling in an aircraft licensed for passenger service as a member of the crew;

- While committing or attempting to commit any unlawful act;

- While participating in any professional sports;

- Martial arts or boxing, aerial activities including parachuting and hang-gliding, underwater activities exceeding fifty (50) meters in depth, mountaineering involving the use of ropes or mechanical guides;

- Racing (other than on foot), pace-making, speed or reliability trials;

- Ionization, radiation or contamination by radioactivity, nuclear weapons material; and

- Riding/driving without a valid driving license (NOTE: this will not apply to individuals with an expired license but is not disqualified from holding or obtaining such driving license under the regulations of the Malaysia Road Transport Department or any other relevant laws).

Making a purchase

You can make the purchase through the Insurance button under Payments in your BigPay app.

Only BigPay users are eligible to purchase this insurance. You can purchase it for yourself or for other BigPay users.

Yes, it is secure with Https protection.

Your insurance policy will be activated immediately upon successful payment.

You will be emailed a soft copy of the insurance certificate within 1 hour from successful payment from bplifestyle@senangpks.com.my. Your insurance policy will be activated immediately upon successful payment

Post Purchase

You can view details on you policy by logging into the Senang portal. Log in details will be in your purchase confirmation email

If you give notice to Allianz to terminate this Policy, such termination shall become effective on the date when the notice is received by Allianz from You on the date specified in such notice, whichever is the later. In the event premium has been paid for any period beyond the date of termination of this Policy, the short period rates shall apply provided that no claim has been made during the Period of Insurance then subsisting.

You may contact Allianz Customer Service Centre at 1 300 22 5542 (Operating hours: Mon-Fri 8.00am-8.00pm) or email: customer.service@allianz.com.my to cancel your policy. Terms and conditions will apply.

For more information on cancelling your insurance, visit senangpks.com.my/BigPay/FAQS.

You may contact Allianz Customer Service Centre at 1 300 22 5542 (Operating hours: Mon-Fri 8.00am-8.00pm) or Email: customer.service@allianz.com.my

It is important that you inform Allianz of any changes in your contact and personal details to ensure that all correspondence reaches you in a timely manner. You can contact Allianz customer service at 1 300 22 5542 (Operating hours: Mon-Fri 8.00am-8.00pm) or email: customer.service@allianz.com.my.

If you did not receive the confirmation message within 1 hour of signing up, please check your Spam or Bulk email folder just in case the confirmation email was delivered there instead of your inbox. If so, select the confirmation message and mark it Not Spam, which should allow future messages to appear in your inbox. The email will be from bplifestyle@senangpks.com.my<.strong>.

If you still can't find it please contact melisa.tan@senangpks.com.my and you will be updated within 1 working day.

Ownership of the policy cannot be transferred.

You may contact Allianz Customer Service Centre at 1 300 22 5542 (Operating hours: Mon-Fri 8.00am-8.00pm) or email: customer.service@allianz.com.my

Claims

You may visit allianz.com.my for further information. You are advised to submit your claim (if any) to Allianz as soon as possible, ideally within 48 hours of the incident date. You can also submit your claim by logging into the Senang Portal.

Your claim will be registered within 3 working days and you will received claim reference number. Your payment of claim will be 7 working days from the date of claim approved.

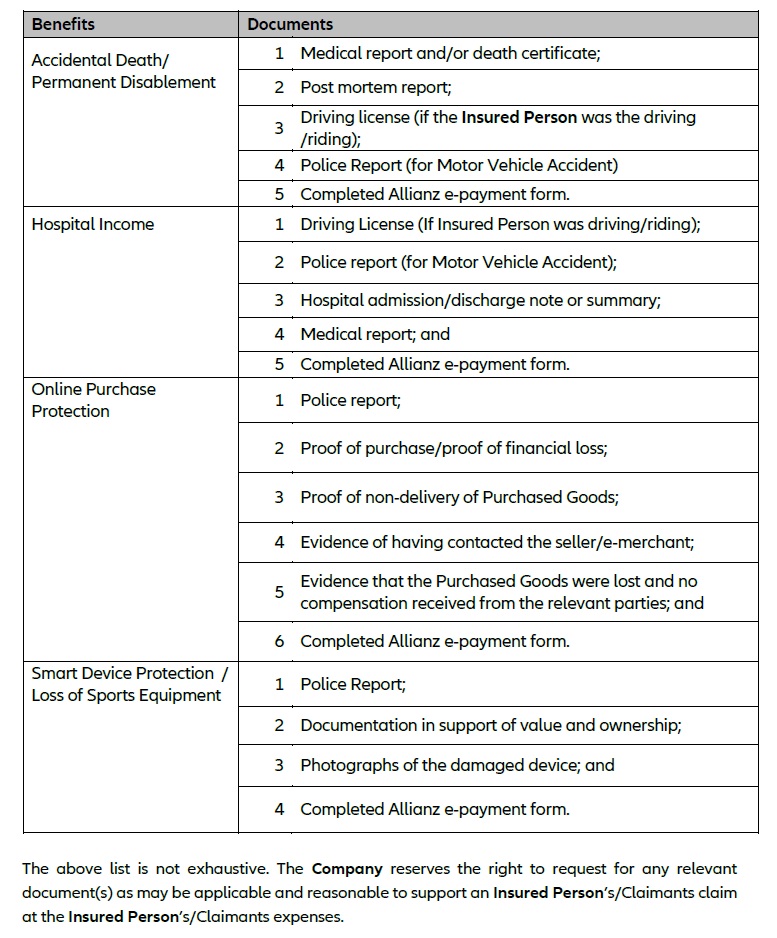

This will depend on the type of claim you are making:

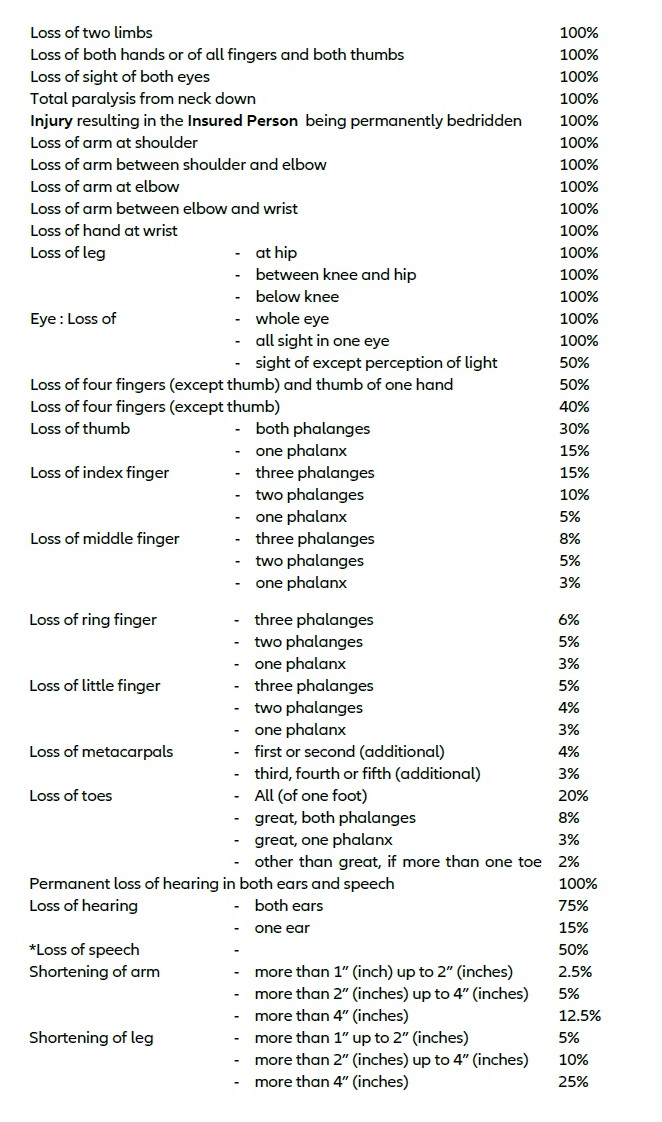

What does Permanent Disablement cover?

What does Online Purchase Protection cover?

What does Smart Device Protection cover?

What does loss of sport equipment cover?

What does hospital income benefit cover?

We encourage you to inform your next-of-kin of your insurance coverage so that they would be able to claim on your behalf should any unfortunate incidents occur. . However along with other documents required to make a claim, your next-of-kin is required to register the death in Malaysia and share the death certificate with Allianz.

Examples of eligible next-of-kin are as

- Spouse

- Children

- Parents

- Grandparents

- Parents –in-law

- Siblings (brother/sister)